How much is 1 bitcoin worth right now in dollars? Follow the price live

Check out how much is one bitcoin valued in dollars today, updating live…

The exchange rate information is valuable for those who actively invest or trade bitcoin and need to check if its current position is working in favor or against one’s plans for the cryptocurrency.

Live bitcoin x US dollars chart

Check out the chart chronicling bitcoin’s latest exchange rates for US dollars to see if its trajectory is moving bearish (down) or bullish (up) over time, also updating live…

What influences the price of bitcoin

Anyone who has followed the value of bitcoin over time knows that its constant ups and downs are both one of its greatest strengths and one of its biggest flaws.

Pinpointing exactly what causes bitcoin’s price to fluctuate is complex. Start with the fact that this digital currency operates on its own autonomous system, is continuously traded without pause, and is available in a vast number of countries. Imagine how many social, economic, and political factors combine to impact bitcoin’s current value.

Read also…

Like any other buying and selling transaction, bitcoin’s price is heavily influenced by supply and demand: the more sought after it is, the more expensive it becomes; the more people looking to sell it, the cheaper it gets. Beyond this, the decision to buy or sell bitcoin is also affected by everything that influences people, entrepreneurs, and investors in the space, as well as how they react to events in financial markets and their ripple effects across various sectors of life.

This dynamic is also subject to direct news about bitcoin: countries banning or easing its use, adoption or rejection by prominent figures, the expansion of digital wallets accepting cryptocurrency, or improvements in broker services. News from the sector can resonate much like in a traditional stock market. Ultimately, it becomes clear that the web of cause and effect surrounding cryptocurrency is as vast as that of traditional currencies.

See more…

Where does the bitcoin-to-USD exchange rate come from

The bitcoin-to-USD exchange rate is not set by any central authority or institution but is determined by market dynamics across multiple platforms where bitcoin is traded. These platforms, known as cryptocurrency exchanges, act as marketplaces where buyers and sellers meet to trade bitcoin for various fiat currencies, including the US dollar (USD).

The exchange rate is a reflection of the price agreed upon by buyers and sellers at any given time. It fluctuates constantly based on factors such as:

Supply and demand

When there is high demand for bitcoin but limited supply, the price rises. Conversely, when more people are selling than buying, the price drops.

Market sentiment

Positive news, such as institutional adoption or regulatory approval, can drive up demand and increase the exchange rate. Negative developments, like bans or security breaches, can decrease demand and lower the rate.

Arbitrage across exchanges

Different exchanges may show slightly different rates due to varying liquidity and user bases. Arbitrage trading (buying on one exchange and selling on another) helps align prices across platforms, contributing to a more unified global exchange rate.

Global economic events

Bitcoin’s decentralized nature means it’s influenced by global economic trends. For example, inflation, currency devaluation, or geopolitical instability can increase interest in bitcoin as a store of value, affecting its rate against the USD.

Trading volumes

High trading activity often leads to quicker price adjustments, while low activity can make the market more volatile and susceptible to sudden price swings.

Read more…

The bitcoin-to-USD rate displayed on financial websites or apps is typically an aggregated value based on averages from multiple exchanges. It’s important to note that while these rates provide a general benchmark, the actual rate may vary slightly depending on the platform where the transaction occurs.

This decentralized and market-driven pricing model is a core feature of bitcoin, reflecting its status as a global, borderless digital currency.

If you have alreadt started in bitcoin or are planning your first steps, always make sure to check the current value at your own bitcoin exchange service to make sure you have the most valid price for your financial operations.

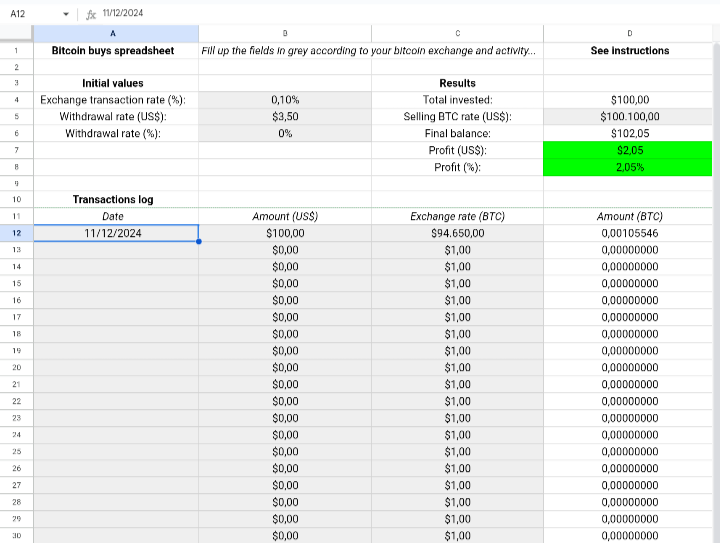

Automated sheet for bitcoin investments over time

Do you want to register and follow your own set of bitcoin buys over a period of time, just like we did on our experiment above?

Here’s an automated spreadsheet you can download do track your investment and its results. It’s programmed just like our record: you can add increments over time, and log your gains as time and bitcoin exchange rate go by.

When you download it, you’ll be granted access to a Microsoft Excel version as well as a Google Sheets version, to make use of it the best way you’d like. You’ll also receive a set of instructions on how to use it and support channel after your download.

Once your order has been completed, you will receive a ZIP file with both versions of the spreadsheet and usage instructions on the e-mail used for the transaction.

If you didn’t receive your material, please, send an e-mail to contact@littitude.com and we will send you the files directly.

Read also…

Get fresh content delivered to you

Sign up to our newsletter and receive our latest updates and exclusive content. No spam, one e-mail per week, maximum!