10 PayPal hacks for digital solopreneurs for maximum results

PayPal is a cornerstone of modern online business. For solopreneurs, it’s more than just a payment processor—it’s a tool that can simplify operations, expand market reach, and provide a secure gateway to global transactions.

But are you using PayPal to its fullest potential? With a few strategic hacks, you can turn PayPal into a powerful ally for your business.

In this guide, we’ll dive into essential PayPal tips and tricks tailored for solopreneurs. From optimizing fees to leveraging advanced tools, you’ll learn how to make the most of the platform while keeping your finances streamlined…

1. Reduce Transaction Fees: Save More on Every Sale

PayPal fees can add up quickly, especially for solopreneurs managing slim margins. Here’s how to minimize them:

- Apply for PayPal’s Micropayment Plan

If your average transaction is under $10, consider switching to PayPal’s micropayment plan, which has a lower percentage fee for small amounts. - Invoice in Bulk

Instead of processing multiple small payments, try invoicing clients in bulk. This can save on the per-transaction fee and simplifies bookkeeping. - Encourage Direct Transfers

Educate repeat clients on sending payments as “Friends and Family” for non-commercial transactions. Note: This should only be used when appropriate and legal.

2. Take Advantage of PayPal Business Tools

PayPal isn’t just a payment processor; it offers a suite of business tools that solopreneurs often overlook:

- Recurring Payments

For subscription services or ongoing contracts, use PayPal’s recurring payment feature. It ensures timely payments and reduces the risk of late fees. - Smart Buttons for Checkout

Add PayPal Smart Payment Buttons to your website. These buttons make checkout faster for customers by offering various payment methods, including Venmo and PayPal Credit. - Invoicing Made Easy

Use PayPal’s invoicing feature to send professional, customizable invoices with integrated payment links. It’s simple, effective, and enhances your brand image.

Read also…

3. Optimize Currency Conversions

If you deal with international clients, currency conversion fees can eat into your profits. Here’s how to minimize the impact:

- Hold Balances in Multiple Currencies

PayPal allows you to hold balances in different currencies. If you frequently work with international clients, consider keeping funds in their original currency to avoid conversion fees until you’re ready to use or withdraw them. - Use a Multi-Currency Account

Pair your PayPal account with a multi-currency bank account or service like Wise (formerly TransferWise) to withdraw funds at better exchange rates.

4. Leverage PayPal for International Sales

PayPal is a globally trusted platform, making it easier for solopreneurs to expand their reach. Here’s how to maximize its international benefits:

- Localized Checkout Pages

Use PayPal’s localization features to offer checkout pages in your customers’ native language and currency. - Offer PayPal Credit

For higher-ticket items, enable PayPal Credit, allowing customers to pay over time while you get paid upfront. - Promote Buyer Protection

Highlight PayPal’s buyer protection to reassure international customers and build trust in your brand.

See also…

5. Use PayPal Reports for Better Financial Planning

PayPal’s reporting tools can help you keep track of income, expenses, and cash flow:

- Monthly Statements

Download detailed monthly statements to simplify your tax preparation and financial tracking. - Export Data to Accounting Software

PayPal integrates with platforms like QuickBooks and Xero, making it easier to manage your books and spot financial trends.

6. Create a PayPal.Me Link

PayPal.Me is a customizable link you can share with clients for quick payments. Here’s how to make it work for you:

- Personalize It

Choose a professional, memorable username that reflects your business identity. - Use It Everywhere

Include your PayPal.Me link in email signatures, invoices, social media bios, and even during client chats. - Encourage Tips

For freelancers or service providers, add a friendly message on your PayPal.Me page to encourage tips or donations.

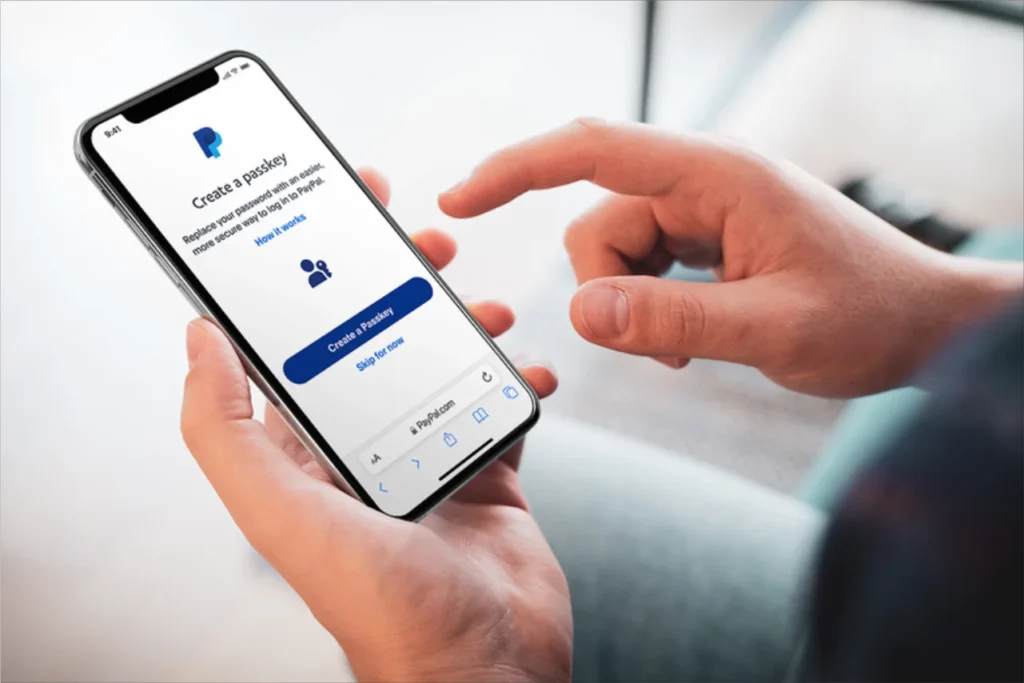

7. Ensure Security and Build Trust

Security is a top concern for solopreneurs and clients alike. Use these PayPal features to protect your business and reassure your customers:

- Enable Two-Factor Authentication (2FA)

Protect your account with an extra layer of security by enabling 2FA through PayPal settings. - Seller Protection Program

Familiarize yourself with PayPal’s Seller Protection, which can shield you from fraudulent claims and chargebacks. - Monitor Transactions Regularly

Review your account frequently for any unauthorized transactions and report them immediately.

Read this…

8. Explore PayPal Alternatives for Flexibility

While PayPal is a fantastic platform, diversifying your payment options can benefit your business:

- Combine with Stripe

Stripe offers advanced integrations and lower fees for high-volume businesses, making it a great complementary tool. - Use Wise for Transfers

For international transactions, Wise often provides lower fees and better exchange rates than PayPal.

9. Stay Updated on PayPal Policies and Features

PayPal frequently updates its features, fees, and policies. To stay ahead:

- Subscribe to Updates

Check PayPal’s blog or subscribe to its newsletter for announcements about new tools and policy changes. - Join Online Communities

Engage with other solopreneurs in forums or social media groups to share PayPal tips and hacks.

For solopreneurs, PayPal is more than just a payment processor—it’s a versatile platform that can streamline operations, open doors to global markets, and provide peace of mind. By leveraging its tools and features wisely, you can maximize your efficiency and profitability while focusing on what you do best.

Whether you’re a freelancer, an e-commerce seller, or a content creator, these hacks will help you turn PayPal into an indispensable part of your solopreneur toolkit.

Keep reading…

Get fresh content delivered to you

Sign up to our newsletter and receive our latest updates and exclusive content. No spam, one e-mail per week, maximum!